this post was submitted on 22 Apr 2024

1033 points (81.3% liked)

A Boring Dystopia

15391 readers

719 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

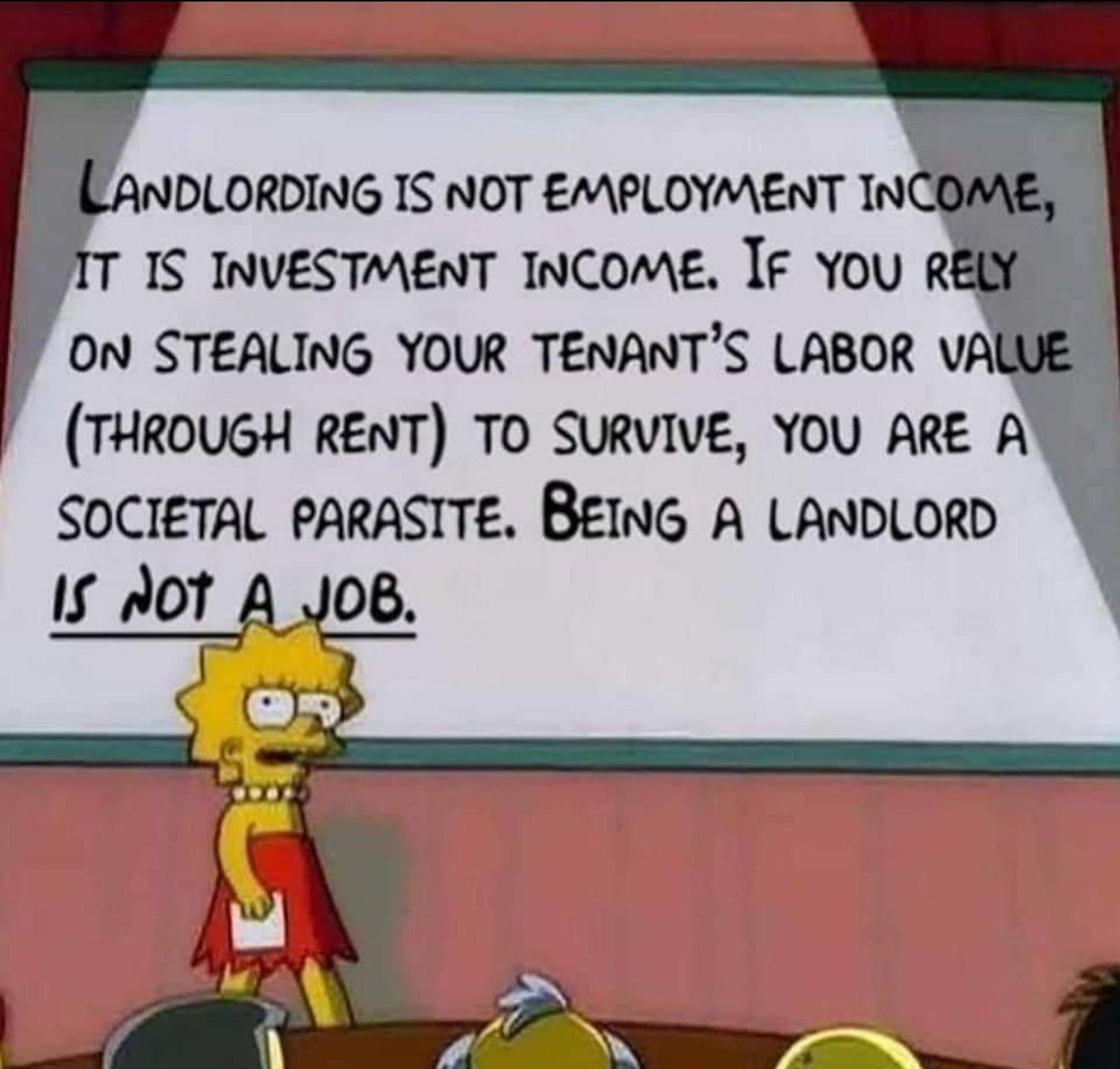

Being a good landlord can be a job, depending on the home and the needs of the tenants and whether or not they're able so whatever work is needed for the place.

The problem is most just want the returns of an investment without the risks of such, and without ever putting any further "investment" into the property after purchase.

Municipal landlords have by far been the best in my experience. They're not for-profit, their employees are strongly unionized (though the ones in private companies might be too) and they actually respond to issues you're having in a timely manner.

You're talking about city/state supplied housing? I've seen good and bad from both but I'm general that seems to be a less and less common thing.

I'm talking about my own experience, which is Sweden. Municipal landlords are not something that's going away. They're usually way more fairly priced and a lot of student apartments are rented by them.

Yeah we need more of that here.

I get what you're saying but it doesn't really address OP's point (which I don't agree with either).

You're really talking about the maintenance and admin required to provide a property to a tenant. OP is talking about charging "rent" for property, which is a unique type of revenue.

What do you think the rent pays for?

https://en.wikipedia.org/wiki/Economic_rent

Yes, I'm familiar with the term. But we're not talking about economic rent, we're talking about landlording, which only overlaps in the terminology used.

Apartment rents and economic rents are two very different things. Economic rent is extracting value beyond the work needed to maintain the thing, whereas an apartment rent includes payment for the work needed to keep the property in good working order.

In some areas, rent is exorbitant, but I'm many areas it's quite competitive. I've evaluated buying a rental in my area, and the profit margins are too slim for the amount of work needed that I choose to invest my money elsewhere. Many seem content with breaking even for some reason and profiting mostly from property valuations increasing.

No shit. Equity is valuable. You don't even need property values to increase. You know eventually you pay off the house, right?

I'm saying even counting that. I'm not talking purely about cash flow, but long term profitability. In looking at properties and local rents, I'm seeing something like a 5-7% growth/year amortized over >10 years after all expected expenses and whatnot, which is quite a bit worse than expected returns in more passive investments like broad market stock index funds.

Granted, I haven't done the math for a few years so things may have changed, but at least at the time I was looking, a lot of smaller rental real estate investors didn't seem to understand how to properly value a property and just yolo'd it. It can make sense with higher volume because the cost per door goes down, but I'm talking about small-time investors with like 1-2 properties and no plans to expand.

Personally, if I'm going to buy a rental, I expect to make more than stocks since I'm taking on extra risk and work. The numbers just haven't looked good in my local area, especially given the higher insurance and borrowing rates for investment properties.

That said, I'm considering it if we move from my house because the lower interest rate makes it attractive (I'm in a sub-4% loan, which should be less than appreciation) and my wife is interested in a part-time job managing a property. Even so, we'd probably still be better off just selling and investing in stocks.

A house is a much safer asset than the S&P. Generally if you have enough wealth you have a mix.

Not necessarily, it's subject to a lot more geographic risk. If you have a properly diversified real estate portfolio (i.e. properties in a variety of geographic locations), sure, it can be less risky, but at that point you're so rich that even wild variation in returns isn't going to impact your retirement.

Your average landlord holding a small basket of priorities likely hasn't properly diversified. It's akin to buying a handful of blue chips, you're trading returns for consistency, but even blue chips fail (see GE) and sectors collapse. So if you're buying properties near you and your local economy tanks, you're kinda screwed. If you diversify, your maintenance overhead will jump and your margins will fall.

There's certainly money to be made, but for real estate it's usually at scale, and I'm not going to have enough money to make scaling realistic (nor do I want that much money anyway).

Ive lived in a lot of rentals. The ones owned by single owners instead of a company were much worse at doing repair work. Not saying big landlord companies are good, cuz they're not, but being able to immediately get a repair man is a good thing. I just dont think the average landlord who depends on rent to pay bills are wealthy enough to eat repair costs so easily.

I've had the opposite experience. The mom and pop landlord did most of their own maintenance and the guy would take time off work to come fix stuff. Whereas the larger property management companies did everything in their power to not fix stuff.

Yeah, if it's their full-time job that's one thing, but if it's a side hustle they're passionate about, it can be a very good experience.

It might be the difference of location. I live in the south where there are probably less restrictions and more regulations.

Ive also had bad experiences with landlords doing their own work, for example i had a small fire in a light socket, called 911 and they came and checked and unplugged the light. The flame went out on its own. So the landlord came out theirself and "repaired" it. Two weeks later it happened again. There was a fire Marshall whatever that is there and told us there would be an inspection in a few weeks. The landlords had a company come out that time and they replaced every light fixture in the house.

Like anything else, there's a ton of variation in quality. Finding a good landlord is just as important as finding a good apartment. Talk to the other tenants before signing anything, look up reviews, etc.

I've had pretty good luck, probably because I do my own due diligence. Good landlords exist.

You sound like you blame renters for choosing shitty landlords when there is no way to verify who is or isn't a good landlord.

There's a difference between blaming renters and suggesting that renters could do a better job. I outlined specific ways I've used to avoid bad landlords: ask tenants and look up online reviews.

Bad landlords should certainly be held accountable by the law. However, that honestly isn't very practical because your average tenant doesn't want to be a part of that drama, so they're more likely to just deal with a bad landlord and vent on social media or whatever.

My whole point here is that good landlords exist and they can be found, it may just take some extra effort on the renter's part to find them.

So you're like some paid itern at a housing company. Because you just come off as a shill whos willimg to over look people's life's going to shit.

It's just that I don't think the high cost of housing is purely the landlord's fault, that's just shooting the messenger. The actual reasons vary by area, but I think they can be broken down into a few categories:

Landlords are only relevant to the final point. They still are relevant, and there should probably be some changes to local landlording laws in many areas, but they're not the biggest cause for problems.

What are you going on about..... it has been shown that landlords have been artificially raising rent for nothing other then pure greed which hurts every day people and only benefits the rich.

They're a business, so they'll charge what the market will bear. Forcing them to take less profits will lead to less pressure to produce more housing, which hurts the supply problem.

Look at places like San Francisco that have rent controls, zoning laws prevent new housing construction, and limits on profits discourage investors from pushing to change those zoning laws. They also encourage people to keep their housing, since leaving then vacant may be preferable to getting a new lease if they need to leave the area for a while.

The proper solution to greed is to increase competition. For the housing market, that means zoning changes to promote higher density zoning paired with transit, and restrict new lower density housing. That way more people can actually use transit routes, which means less need for roads, which means more room for housing in cities and less tax dollars spent on maintenance.

No dude high rent is bad for almost everyone. People cant buy houses because most of them are owned by big corporations that squeeze every cent out of people.

I agree, I'm just saying attacking landlords is attacking symptoms, not the root cause. The root cause is lack of supply for affordable homes, and that's a more complex issue largely stemming from COVID-related supply disruptions.

I've had both. I'm the end they're represented by people. Some apartments had good apt-managers and a property company that invested in maintenance. At least one was cheap on maintenance and tried to screw me when I got injured due to such. Their insurance company was surprisingly decent and compensated me reasonably.

I've had landlords that were similarly awesome. Usually a basement suite or an old person who rented out to students, and I got lucky with my choice of roomies. I've also run across the cheap bastard variety, and some that were downright sinister with some ego thrown on top.

Thing is, the number of good landlords seem to have decreased over time. Most cited a bad tenant experience. Some were older and couldn't keep up with it. It feels like the "fuck them, they're probably just out to screw me so I'll screw them first" mentality is growing on both sides of that fence and I'm the end it's the decent people who end up screwed they most (on both sides).

Yeah, the idea of rent being required to pay for the property is stupid in general, and should not be allowed, but it seems various financial institutions do calculate that in among the variables for lending.

In the past, I did have a small 2bdrm not too far from a university. After I broke up with my partner at the time, I rented out the room but the non-bedroom areas of the house were common, so it felt more like a roommate situation (we also hung out together, had meals, etc)

Part of the money I got - which wasn't huge - went into saving, and part of that saving was the "oh shit fund". A few times, the "oh shit" moment was stuff that broke. down around the place, special levies by the strata, etc.

Anyone who is renting out a full place and not setting aside maintenance/repair money is an idiot or an asshole. Probably both.