60

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

this post was submitted on 30 Oct 2024

60 points (95.5% liked)

InsanePeopleFacebook

2593 readers

326 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

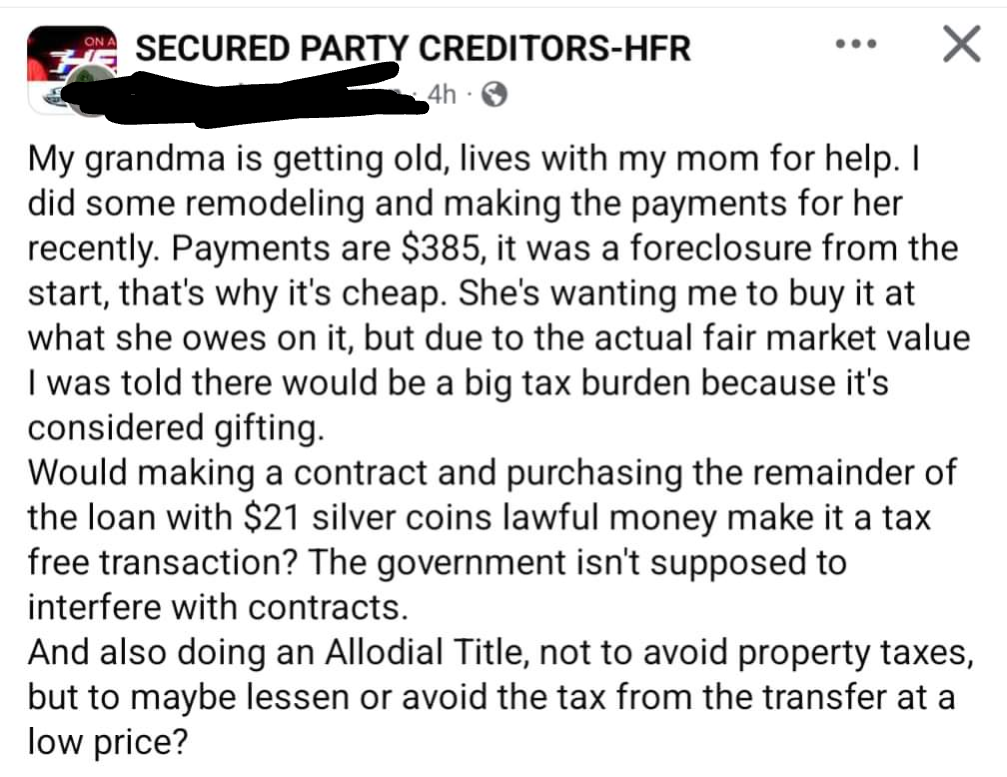

If I understand this person correctly, they're asking about how they can cheat their grandma?

Basically, grandma bought a house, hasn't paid off the loan, and the house is foreclosed. He wants to buy the house (maybe with his Grandma's blessing) for the remainder of the loan amount. Because the "value" of the house, as determined by the market, is much higher than the amount remaining in the loan, he would have to pay taxes for acquiring a "gift" amount of the difference.

It's complicated because it gets into wealth transfer laws, and how taxes work in a particular system.

On one hand, generational wealth is a real problem because it lets the rich get richer down their lineage especially for the ultra wealthy, but on the other, if my parents want to give me a house that they paid for and own, why should the government be able to demand some 20k in taxes for my inheritance?

The funny thing is, the gift wouldn't be taxed anyway. It's certainly valued less than the multi-million-dollar federal lifetime gift tax exemption (and no state has an exemption under 1 million, either)

There's a yearly limit for gifts at $18k in 2024.

True, but anything over that just counts toward estate tax, which has the aforementioned exemptions.

Then again, why should you have a house (or billions) and I not?

Your parents maybe worked for it, but you didn't. If your parents are rich, then you have probably had more help in life than someone with poor patents.

This is what I think is the correct way to deal with inheritance, good for you if you get a house btw!

Why does the state, or for that matter any of y'all fuckers, be entitled to my parent's hard work?

They got taxed on their income all their lives. They paid property taxes all their lives. And here you are, looming over their dead bodies, still trying to get your grubby little hands in their pockets.

This is why estate taxes only kick in at a pretty large amount. For instance the threshold for the US federal estate tax to kick in is 13,990,000 dollars and up, for 2025. For the state I live in there is no estate tax.

If you're up in that range and above then you can also be pretty sure that no, they did not pay the same taxes working class people do, they probably paid less.

It's just used as a talking point for Republicans because people like yourself don't realize that by the time it kicks in the recipient is already set for life and people that rich probably weren't paying their fair share into the system anyways.

You know, grave robbers were considered the lowest scumbags and summarily executed.

And during that time there was feudal relief, which was a one time payment for someone to inherit estate-in-lands or fiefs.

Kind of like if your inheritance was rich and powerful enough you needed to pay a tax to have the inheritance passed on. Otherwise the state didn't give a fuck. Sound familiar?

In my country, monarchs were beheaded for their crimes.

I'm not talking about you personally, I'm talking about the general idea of taxing inheritances.

If you don't tax it, we'll all end up working for jeff besos grand son, for peanuts and no house.

Also, if you get a bunch of grands, I can live with that, you got lucky, good for you. But millions? Not so much IMO.

Jealousy is a sin. Y'all just mad people busted their asses off to improve their lives and the lives of their children while you're sitting here whining to your cats about how it's unfair you don't get a share of the pie.

So is Greed, which is the only accurate term for multi-millionaires. Though if those multi-millions come from one(1) house, that's a different thing. Housing market is snafu.

It isn't really jealousy, or envious, to be more precise, to demand the rich have a higher tax burden than the working people. Everyone should be contributing their fair share of taxes, and that share gets bigger the more you get/have, as you wouldn't even notice it being gone (unless you were a hording dragon, obsessed with every small piece)

You talk about greedy people, and yet here you are demanding a slice of other people's pies because you never have enough you greedy little goblin.

Would that really be a gift? How does that work?

I'd bet generational wealth ain't what it's cracked up to be. Hows the saying go? "The first generation makes it, the second generation spends it, and the third generation blows it." Seen that quite a bit in my life experiences.

The only cases where generational wealth really comes into play are with truly wealthy families, and even then the house can come crumbling down. Wealth that can survive through several generations is quite rare.

If grandma don't know how to play the game, that's on her.