this post was submitted on 15 Jan 2024

1611 points (97.8% liked)

Political Memes

11052 readers

2187 users here now

Welcome to politcal memes!

These are our rules:

1) Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

2) No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

3) Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

4) No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

5) No AI generated content.

Content posted must not be created by AI with the intent to mimic the style of existing images

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

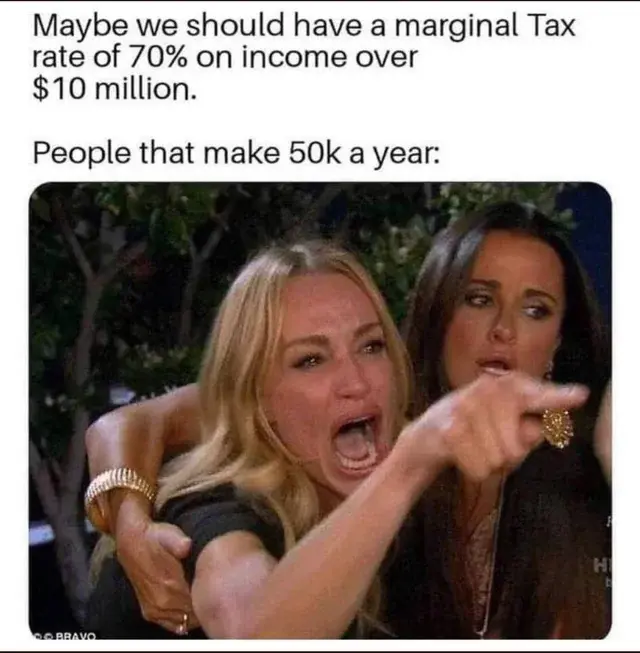

Measures like these often fail, because a lot of people dream of being these people that earn that much money. They don't want to limit their possibly future unrealistic imaginary self.

This is commonly repeated, but I wonder if the majority of folks are actually against something like a 70% tax rate on $10 million per year in the absence of all other issues.

I think most republicans are actually in favour of such a tax, they just care about the other issues they are told about by their news sources like crime, religion, and immigration more.

There is also a legitimate concern about the tax money being misused or stolen. The amount of taxes already collected per year is already incomprehensibly large, yet society gets almost nothing for it.

What do you mean by "absence of all other issues", though? I find figures as high as 62% of Americans favoring a Flat Tax (admittedly, it's all over the place). Many MANY Americans are convinced that everyone paying the same percent of their income is "fair".

Massachusetts, a very left-leaning state as far as that goes, managed to pass a much more conservative millionaire tax by ballot initiative, but only managed to get 52% yes votes. And the vote arguably only succeeded because it was mere a 4% (?!?) tax on income over a million.

And the entire "NO" push was based around "what if YOU make a million for one year? It will devastate you!" And they got 48% of the vote.

Arguably, a flat tax could tax the rich more, as long as it applies to capital gains, qualified dividends, municipal bonds, and other tax shielded types of income. Maybe muni bonds can be excluded, since that would harm all local and state governments.

If you are rich and living off investments, your total tax is less than 20%. It could be 15% or less, depending on your sources of income. A flat tax of 20% (or more) would tax these people more. Of course that reduces all the policy the US has implemented through tax breaks (donations to charity, green improvements, investments in disadvantaged areas). Voters can be dumb and may not realize that tax cuts are spending money.

I think we're thread-mixupping here. I was directly replying to someone talking about a 70% tax on income over a certain arbitrary number ($10M/yr)

You're not wrong that a blend of flat tax and treating all material gain as income could tax that one specific scenario more. But it really is a different topic. My take on that topic is "sure, but let's not do it as a flat tax at all. Progressive tax PLUS carefully situated handling of capital gains"

Honestly, we're 99% there if we just revisit all the laws that defer or waive capital gains tax and set a networth ceiling on them. It's ok to defer retirement gains, but maybe not after you have $20M in retirement? The way it works with selling owner-occupied real-estate in my area is a $250K "grace area" for profits, then you're taxed on gains less all bills/investments into the property. For most Americans even lower-upper-class, that's $0 of liability.

We can do the same with retirement, say at the $4m mark (twice the current recommended retirement total, or just round up to $5m). With stocks "ditto, pick an arbitrary large number more than most Americans have). Whatever.

But add a flat tax to that? Why.

That's true. Voters are more than happy to spend $500 on a $400 tax cut instead of spending that same thing on something that increases their quality of life by approximately $1000 (either by increasing the buying power of the dollar or community-profiting subsidies like EBT).