this post was submitted on 13 Sep 2023

900 points (97.4% liked)

Memes

54594 readers

1314 users here now

Rules:

- Be civil and nice.

- Try not to excessively repost, as a rule of thumb, wait at least 2 months to do it if you have to.

founded 6 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

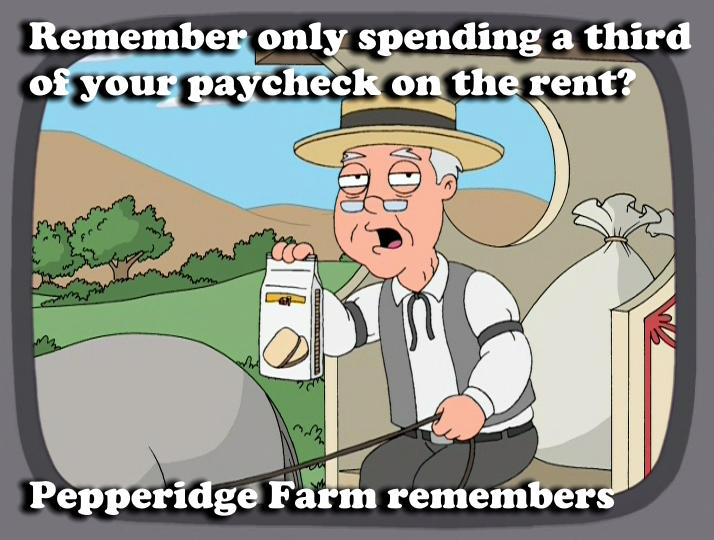

Older millenial here.

Max I ever spent on renting was 25% of my net income, but usually it was more like 20%. Now I actually spend only 10% of my net income on my mortgage, thanks to inflation helping my income while keeping the mortgage static.

(Sure there are also taxes on top of the mortgage, but I'm also building equity. Taxes + interest is even less than 10%)

Younger generations are definitely getting screwed.

Don't accept the status quo.

Just curious about your perspective. What would you think are some good ideas on changing the status quo?

I think that outlawing real estate as investments would mean that high to medium density living spaces like apartment complexes or high rises in cities don't get built, and allowing the government to dole out who gets what properties is another recipe for disaster.

Please don't take this as confrontational, I'm genuinely trying to consider what alternatives some people are thinking about.

I think Henry George had the right idea.

Fact is, as people get more money, they want bigger homes, second homes, rental properties, etc...

It's going to be a never ending bidding war between citizens to own the most and nicest properties.

So the solution is to tax real estate at high rates, but give that money back in the form of deductibles on income tax to the middle class who live in their middle class owner occupied homes.

Another part is to let government build a huge supply of very basic, affordable housing, which then serves as a price anchor.

Basically, not outlawing homes as investment, but making them unappealing as investments.

Most developed countries had or have systems like this in place. They just need strengthening.

Tax the shit out of residential real estate investments for corporations and anything beyond the first 3 dwellings owned by individuals. Carve out exceptions for apartment complexes.

Stop corporations from owning anything other than appartments buildings full stop.

Tax the shit out of anything other than the primary residence.

I wouldn't carve out an exception for apartment complexes.

Transition apartment complexes to a condo model with HOA fees to cover all the shared upkeep and expenses. Limit HOA fees to real upkeep costs and expenses (no massive profits for a HOA management company).

My sister-in-laws first place was an apartment complex converted to condos. Her mortgage plus HOA fees where the same as the rent on a comparable apartment in he area.

When she got married, had kid, and purchased a larger place 5 years later, she got her down payment plus all of her mortgage payments back (sold it for 10% more than she bought it for).

Stop vilifying the poor, high subsidies and incentives for living in high-density housing including de-incentivizing predatory landlords, increase taxes on the rich, and a sliding scale of taxes on multiple properties with the lowest rates affecting the lowest value properties.