back in my map era, we're ukrainemaxxing right now

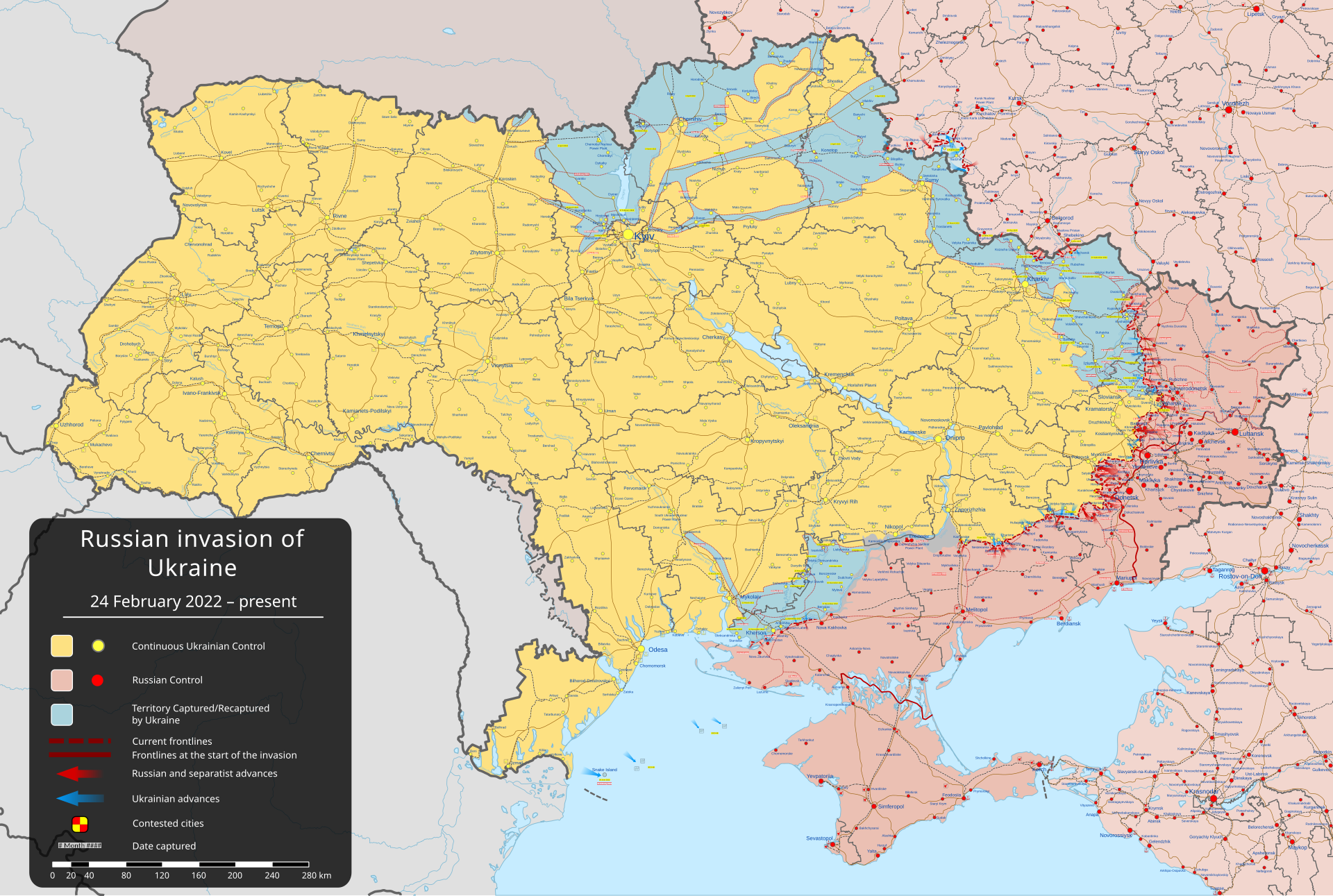

Declarations of the imminent doom of Ukraine are a news megathread specialty, and this is not what I am doing here - mostly because I'm convinced that whenever we do so, the war extends another three months to spite us. Ukraine has been in an essentially apocalyptic crisis for over a year now after the failure of the 2023 counteroffensive, unable to make any substantial progress and resigned to merely being a persistent nuisance (and arms market!) as NATO fights to the last Ukrainian. In this context, predicting a terminal point is difficult, as things seem to always be going so badly that it's hard to understand how and why they fight on. In every way, Ukraine is a truly shattered country, barely held together by the sheer combined force of Western hegemony. And that hegemony is weakening.

I therefore won't be giving any predictions of a timeframe for a Ukrainian defeat, but the coming presidency of Trump is a big question mark for the conflict. Trump has talked about how he wishes for the war to end and for a deal to be made with Putin, but Trump also tends to change his mind on an issue at least three or four times before actually making a decision, simply adopting the position of who talked to him last. And, of course, his ability to end the war might be curtailed by a military-industrial complex (and various intelligence agencies) that want to keep the money flowing.

The alignment of the US election with the accelerating rate of Russian gains is pretty interesting, with talk of both escalation and de-escalation coinciding - the former from Biden, and the latter from Trump. Russia very recently performed perhaps the single largest aerial attack of Ukraine of the entire war, striking targets across the whole country with missiles and drones from various platforms. In response, the US is talking about allowing Ukraine to hit long-range targets in Russia (but the strategic value of this, at this point, seems pretty minimal).

Additionally, Russia has made genuine progress in terms of land acquisition. We aren't talking about endless and meaningless battles over empty fields anymore. Some of the big Ukrainian strongholds that we've been spending the last couple years speculating over - Chasiv Yar, Kupiansk, Orikhiv - are now being approached and entered by Russian forces. The map is actually changing now, though it's hard to tell as Ukraine is so goddamn big.

Attrition has finally paid off for Russia. An entire generation of Ukrainians has been fed into the meat grinder. Recovery will take, at minimum, decades - more realistically, the country might be permanently ruined, until that global communist revolution comes around at least. And they could have just made a fucking deal a month into the war.

Please check out the HexAtlas!

The bulletins site is here!

The RSS feed is here.

Last week's thread is here.

Israel-Palestine Conflict

Sources on the fighting in Palestine against Israel. In general, CW for footage of battles, explosions, dead people, and so on:

UNRWA reports on Israel's destruction and siege of Gaza and the West Bank.

English-language Palestinian Marxist-Leninist twitter account. Alt here.

English-language twitter account that collates news.

Arab-language twitter account with videos and images of fighting.

English-language (with some Arab retweets) Twitter account based in Lebanon. - Telegram is @IbnRiad.

English-language Palestinian Twitter account which reports on news from the Resistance Axis. - Telegram is @EyesOnSouth.

English-language Twitter account in the same group as the previous two. - Telegram here.

English-language PalestineResist telegram channel.

More telegram channels here for those interested.

Russia-Ukraine Conflict

Examples of Ukrainian Nazis and fascists

Examples of racism/euro-centrism during the Russia-Ukraine conflict

Sources:

Defense Politics Asia's youtube channel and their map. Their youtube channel has substantially diminished in quality but the map is still useful.

Moon of Alabama, which tends to have interesting analysis. Avoid the comment section.

Understanding War and the Saker: reactionary sources that have occasional insights on the war.

Alexander Mercouris, who does daily videos on the conflict. While he is a reactionary and surrounds himself with likeminded people, his daily update videos are relatively brainworm-free and good if you don't want to follow Russian telegram channels to get news. He also co-hosts The Duran, which is more explicitly conservative, racist, sexist, transphobic, anti-communist, etc when guests are invited on, but is just about tolerable when it's just the two of them if you want a little more analysis.

Simplicius, who publishes on Substack. Like others, his political analysis should be soundly ignored, but his knowledge of weaponry and military strategy is generally quite good.

On the ground: Patrick Lancaster, an independent and very good journalist reporting in the warzone on the separatists' side.

Unedited videos of Russian/Ukrainian press conferences and speeches.

Pro-Russian Telegram Channels:

Again, CW for anti-LGBT and racist, sexist, etc speech, as well as combat footage.

https://t.me/aleksandr_skif ~ DPR's former Defense Minister and Colonel in the DPR's forces. Russian language.

https://t.me/Slavyangrad ~ A few different pro-Russian people gather frequent content for this channel (~100 posts per day), some socialist, but all socially reactionary. If you can only tolerate using one Russian telegram channel, I would recommend this one.

https://t.me/s/levigodman ~ Does daily update posts.

https://t.me/patricklancasternewstoday ~ Patrick Lancaster's telegram channel.

https://t.me/gonzowarr ~ A big Russian commentator.

https://t.me/rybar ~ One of, if not the, biggest Russian telegram channels focussing on the war out there. Actually quite balanced, maybe even pessimistic about Russia. Produces interesting and useful maps.

https://t.me/epoddubny ~ Russian language.

https://t.me/boris_rozhin ~ Russian language.

https://t.me/mod_russia_en ~ Russian Ministry of Defense. Does daily, if rather bland updates on the number of Ukrainians killed, etc. The figures appear to be approximately accurate; if you want, reduce all numbers by 25% as a 'propaganda tax', if you don't believe them. Does not cover everything, for obvious reasons, and virtually never details Russian losses.

https://t.me/UkraineHumanRightsAbuses ~ Pro-Russian, documents abuses that Ukraine commits.

Pro-Ukraine Telegram Channels:

Almost every Western media outlet.

https://discord.gg/projectowl ~ Pro-Ukrainian OSINT Discord.

https://t.me/ice_inii ~ Alleged Ukrainian account with a rather cynical take on the entire thing.

(continued pt.3)

What is the intent behind China issuing dollar-denominated bond in Saudi Arabia? Can it really help Belt and Road countries pay back their dollar debt?

expand

The answer is so ridiculously simple that I don’t even know why there are so many mental gymnastics involved: the Saudis don’t want to buy the bonds in yuan, they want to pay in dollars (because they have a shit ton of those), and so China obliged because they want to build a closer business relationship with Saudi Arabia who supplies them with oil.

Of course, any investor can buy those bonds, but the sentiment remains the same: the Middle East is not going to be yuanized for sure.

The goal of Saudi Arabia is to dollarize the BRICS countries (in this case, the Middle East), not to help them de-dollarize. There is simply no incentive for Saudi Arabia to do so, and China also benefits from a dollarized world since they have committed to a net exporter status for the longer term, and so they would prefer others not to save in yuan (rather, they want people to use yuan to import stuff from China, not as a saving instrument like the dollar).

—-

I hope this very long post has been educational to those who are interested in learning. There are so many misinformation around the internet these days, and it is easy to fall into their narratives (especially since I am seeing more “multipolar grifters” taking advantage of the anti-imperialist sentiment to promote gold and crypto by scaring people into thinking that their dollar savings will be worthless because the US dollar is going to collapse anytime soon).

Learning about how the system works from a materialist and Marxist perspective can at least shield us from these propaganda that only serve to strengthen right wing neoliberal ideology, and the unfortunate fact that many on the left has subscribed to and continue to believe in such nonsense that only harms our cause.

nice posting. thank you.

Thank you for your patience and wisdom

Read all these posts in Michael Hudson's voice jsyk

I really appreciate you taking the time to write this out. I was especially pleased with your explanations of treasuries/taxes in regards to floating exchange currencies. This concept is one that a lot of my learners struggle with, because we are so deeply engrained with ideas that tax dollars pay for services. I've made it a point to include simple economics in my curriculum, but this particular topic is one that I find learners need to continually relearn; they seem to have gotten it but then a few weeks later whatever articles they've read in the interim seems to have reset their understanding.

Entirely on agreement and on your last point I'd like to add a bit more about China and Saudi Arabia from my other take here

KSA is moving away from oil.

SA is serious about their "Vision 2030" project and Chinese investment seems key to that. Saudi wealth fund signs $50 bln of deals with Chinese financial firms

Better yet, it is working for them.

Saudi Arabia’s non-oil activities hit a historic 50% share of the country’s real GDP in 2023, the highest level on record, according to an analysis of the General Authority for Statistics data by the Ministry of Economy and Planning.

China ready to work closely with Saudi Arabia, advancing together on path of development: Premier Li

I mentioned earlier my first reaction was its no surprise China is making moves to help Saudi become a financial hub, Goldman Sachs literaly last month as the first Wall St firm to open offices in Rydiah.

I speculate this will be where CN vs US battle takes place for the future of the ME. For KSA this is already working for them.

Here is why I think China-KSA relations is probably the underlying reason for this move and not some grand dollar plan.

-China wants to secure good relations with SA in case Iran-Israel happens and in case someone starts targeting Chinese vessels with oil going from Saudi. Turn your head away now: Chinese envoy reiterates call for Houthis to respect rights of navigation in Red Sea

-KSA is serious about peak-oil and they want a path out if it. KSA understands the petrodollar is dead due to climate change anyway or the inevitable wars. KSA is securing investments from both sides and this is probably where CN wants to compete for influence.Remember it was the US that pushed CN away from Israel as CN influence grew threw BRI investments last decade e.g Haifa port, Israel IT etc. It could well be just China doing the same thing again in KSA.

-KSA got a massive advantage over Russia or Iran when competing over Chinese demand: US sanctions against RU/Iran. It means KSA can get, as they are already, billions worth of tech and industrial dials not available to either Ru/Iran. This benefits China as well as KSA becomes even more dependent on Chinese investments.

Fantastic write-up, comrade.

I appreciate the effort post. There are a few things that I would like to question.

RE 1,2 The purpose of China's bond issuance is to attack the ability of the US to spend dollars by decreasing the supply dollars available to the US government.

As you said correctly this is nonsense, the purpose of an American Bond is to remove excess dollars from circulation and to prop up the value of the of the US dollar.

This however is not the purpose of a Chinese issued dollar denominated bond. For the Chinese there is no incentive for them to maintain the value of the US dollar by not spending it. For them a bond is a short against the American dollar. The less valuable the dollar is the less valuable the interest they have to pay on the bond is.

Thus the avenue of attack is on the US is an attack on their currency like the 1997 Asian Financial crisis. The Chinese bonds would deprive the US an avenue to soak up dollars in circulation and cause their currency to devalue. Addressing point 2, how much of an effect can they have. The extent they are able to do this depends not on their dollar reserve but other dollar holders willingness to buy their bond.

While dedollarization is necessary to weaken US hegemony, it is not something that China can achieve unilaterally. While paying off the debts of other nations may allow them the material conditions to dedollarize, China would have to bet that they have the productive/ideological forces to do so, which they might not. If they were to lose this bet, this would mean they have lost their dollar reserve and their ability to do this at a more ripe time, which had taken them decades to build.

Chinese policy making has historically been risk adverse. Expectations that they take drastic actions as opposed to laying foundations are unrealistic. For China laying foundations means weakening the US Dollar, increasing the productive forces in prospective nations and building a shared community for a multipolar world.

Thanks for the quick response.

I don't disagree that dedollarization is a necessity, I do disagree that this does nothing towards that end.

I tried to be precise in the language I used to make a distinction between inflation and the value of currency. While the two are correlated, that correlation is not exact, if they were purchasing power parity would not be a thing and we could be able to directly compare economies using nominal gdp.

While the forces that drive inflation are relevant for Americans, the forces that drive currency exchange are what is relevant for the rest of the world. I brought up the Asian Financial Crisis, because I felt that was the closest analogy to the effect of these actions would be. While the US would may have mechanisms to contain the fallout it would not be without consequence.

Dedollarization is difficult. There is groundwork that needs to be laid and it will not be in a single step nor in a single agreement. For those of us who look at this action and see promise; it is because this moves ultimately signals that the Chinese are committed to a long term devaluation of the US dollar. Short term yes there are more dollars floating around, but the move long term makes the move away from the dollar more palatable to countries beyond those who are already committed.

GOOD POST!