this post was submitted on 19 Mar 2024

1550 points (96.4% liked)

Political Memes

11143 readers

1510 users here now

Welcome to politcal memes!

These are our rules:

1) Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

2) No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

3) Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

4) No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

5) No AI generated content.

Content posted must not be created by AI with the intent to mimic the style of existing images

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Not for profit, there isn't. Profit as a concept in contemporary economics already doesn't pass the sniff test, but housing especially doesn't.

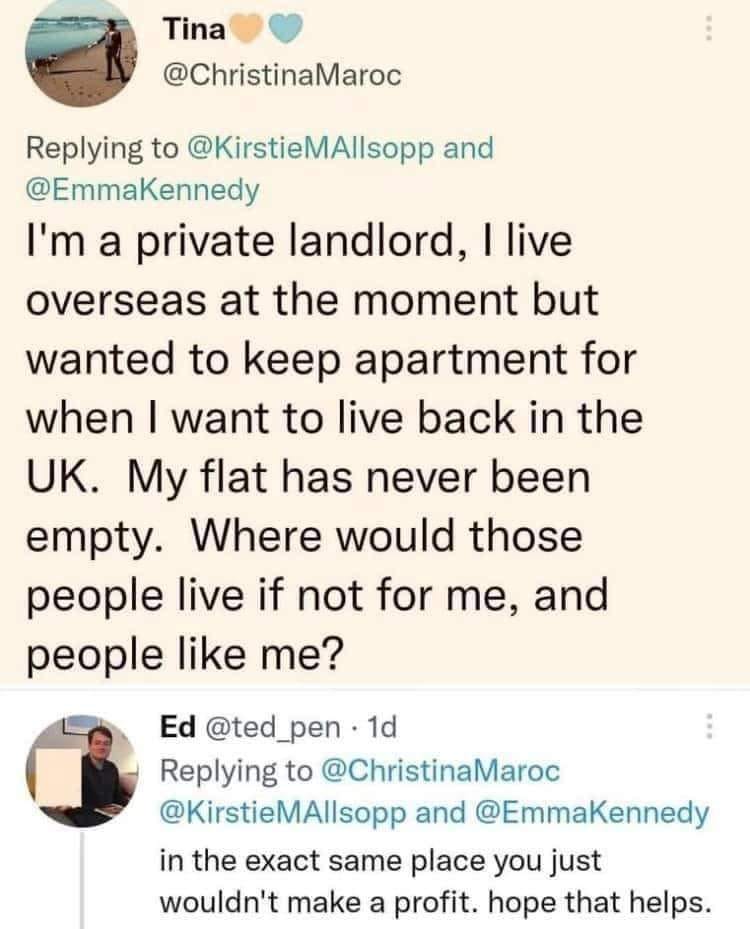

The person in the tweet doesn't claim to be making a profit at all. She's basically saying she isn't going to sell the apartment, so if she didn't rent it out, then it would just sit empty.

The way the real estate market is currently set up, a property sitting empty still generates profit as a financial asset. This is the major issue with rentier capitalism, not your average middle class homeowner with an extra property for rent.

Please expand.

Home value goes up over time.

Yeah but you're paying taxes and maintenance. It's actually not a great investment vehicle if it's sitting empty, it's just generally very safe.

Safe is the point. At least in the US, property taxes are substantially cheaper than anything you could do with liquidity, plus you can tap into the value partially or wholly without actually incuring much risk, or even taking that long. Owning property allows you to have collateral for loans and other financial investments which have larger yields, but require something up front. It is entirely possible to get a loan against a house for an investment, then pay it off with the yield of a previous investment so you don't have interest accruing. As long as you are savvy and intelligent with the investments, it is reasonably sustainable, especially if you are profiting off the property anyway. Who cares about an extra loan payment if you aren't the one paying it.

This all stems from someone claiming an empty property still generated profit. You seem to be arguing that if someone else is paying your mortgage (i.e. a renter) then you can profit by borrowing against the equity in the property. I agree with you, but I don't see the sense in borrowing against an empty place as you are just giving some of your profits to the lender.

The benefit of the ability to borrow against it comes from being able to take part in other investment opportunities. Someone has a company they are starting, you can take a mortgage to invest in it and a year later potentially pay off the mortgage (depending on the size) and it can be empty or not. There are other financial vehicles that have a similar pattern. Even taking a mortgage on a property to take advantage of stock shorting or w/e.

Short answer, if appreciation (the increase in value over time) exceeds costs (taxes, maintenance, mortgage interest, minimum utilities, etc), you are profiting (unrealized capital gains) just by owning the house, similar to stocks and bonds.

Understood. This stems from someone claiming that renting it out for profit is in and of itself wrong. Applying what you said, all renting is criminal according to their logic.

Why rent it out if you’re not making a profit?

In her case, so she has a place to move back to if she comes back. Although I have a friend who has a few properties that he rents out basically at cost (mortgage, taxes, insurance, maintenance) and has them as an investment properties.

So rent goes where if not in profit? Maintenance??

Taxes, maintenance, a management company but probably most of all the interest on the insanely large loan you took out to get it. We “bought” a house with a 30 year loan and if we were to rent it out right now at market rate, there would be no profit. We would probably take a small loss other than the opportunity to hold the property hoping that the price of housing continues to rise. It hasn’t risen since we bought the house a couple of years ago. If you’re old enough to remember 2008, then you also know that it doesn’t always go up. Sometimes it goes down pretty dramatically and you’re left holding the bag.

If the house sits empty between tenants, those costs don’t go away. So for me, in my one bathroom house, that would be $2,400 a month (not including maintenance.) Where is that money gonna come from? I don’t have it because I’m paying rent somewhere else to try and make more money to dig my way out of this hole in this hypothetical situation.

So why not sell? To sell it, we have to pay 6% to real estate agents. If we actually owned the house, not just a massive soul-crushing loan, fine. But we don’t. So that 6% is a SHITLOAD of money when you borrowed all of it besides the 15% down payment that was two people’s life savings plus begging for more from relatives. So selling means half your combined life savings and the money you begged from relatives, poof gone.

Most people have a mortgage like this and amortized interest rates mean that in the beginning, 90% of the money you give the mortgage company goes straight to interest because you pay off 30 year’s worth of interest up front so that they’re sure they get their profit (and because paying the full 5% interest on a note that big every year would be impossible for most people.)

People who bought recently, have a mortgage and a single home that they rent out are not making any profit in areas with expensive housing. It’s not like houses are cheap to “buy” in the first place. They get you good.

Why buy at all then? Because I don’t like landlords telling me what I can and can’t do. So much so that I gambled it all on “buying” a place.

Mortgage, maintenance, insurance, taxes

Profit is a byproduct of free exchange of labor. Most people wouldn't labor if it was net negative for them.

FTFY

Value is added regardless of whether the labor was freely exchanged.

That said: rent isn't a result of any labor at all

I agree, however, a good landlord who maintains their property and promptly resolves issues will have to invest an element of time and money into the process.

That being said, fuck landlords in general.

That job exists - they are called maintenance workers: plumbers, electricians, roofers, handymen...

What makes a landlord a landlord - and not a handyman - is the ownership of property and extraction of rent for its use. It is definitionally not the labor involved in maintaining it.

If landlords want to be paid for maintaining properties they can get jobs as maintenance workers.

The value of a landlord in theory is that they rent at a rate lower than what the mortgage would be, since the renter isn't going to own the property at the end of it. And in turn the renter is wanting short term accommodation. The issue is various conditions have led to home prices always going up.

I don't mean to sound rude, but this might as well be fan fiction.

Ok

Landlord is the role of owner, not maintainer/manager of the property. Sure, they can be the same sometimes (even then most of the actual work gets outsourced to professionals), but anyone can enlist the help of a real estate manager. We usually tend to call them janitors.

Also there are huge open funds specialising in real estate (for rent revenue, for dev/resell potential, or both) that have like a 100 property managers that just need to keep their tenants happy. What that actually means is that investors pool their moneys into a fund with fund managers that buys real estate, finds tenants that wound pay a higher rent under certain conditions (eg I want a huge concert hall in the center of our office complex), fund has the capital to make it happen & evicts the current tenants (unless they can match the rent of the place with a concert hall but without actually having it).

Exactly. Profit actually muddies intrinsic value added since the main driver is purely financial, not actual irl. And you can make a (steady) profit on/with things that don't add value.

What is intrinsic value?

Well yes and no. Profit is a byproduct of profitable labor, not all labor. If you're hunting for food for energy, but don't catch anything (or catch less than you expended), that was labor but it was not profitable. Which is a criticism I didn't really point out before either, but my argument was more to say when there is free exchange of labor it is much more often profitable.

Most people wouldn't labor 40+ hours a week for the wages they are getting if they had alternative methods of obtaining food, healthcare, and housing. There is no real-world "free exchange." You have to deliberately ignore the coercive part to pretend it doesn't exist, because it is obvious. People need to participate in the economy to survive.

I agree it is coercive, but not because of a need for food or shelter. That need is the natural state of humanity, there is no one imposing that need on you. There is no one coercing. But I absolutely agree there are plenty of other coercive factors.

Would you accept if I say "exploitative" instead of "coercive?" I just think for the economic model to price things efficiently, inelastic goods like being alive need to be external to the model. I disagree with describing what we have as a willing exchange.

There definitely can be exploitative factors, just like coercive factors, and housing for example to an extent is exploitative, as in exploited by politicians. But I don't think food sales are really exploitative.

Ofc, stuff that you can't really live without (or be considered poor without) cannot be market priced/for profit because the only thing stopping soaring prices would be a revolution/revolt ... and we were pretty pacified throughout our upbringing. Even silly/obvious things - like people automatically condemning (financially poor) looters of megacorps with unimaginable private profits.

I'm not sure what you mean by this. Do you mind explaining?

Profit no longer serves the only productive class, the working class, in any fashion.