this post was submitted on 07 Mar 2024

994 points (91.3% liked)

General Discussion

14229 readers

1 users here now

Welcome to Lemmy.World General!

This is a community for general discussion where you can get your bearings in the fediverse. Discuss topics & ask questions that don't seem to fit in any other community, or don't have an active community yet.

🪆 About Lemmy World

🧭 Finding Communities

Feel free to ask here or over in: !lemmy411@lemmy.ca!

Also keep an eye on:

- !newcommunities@lemmy.world

- !communitypromo@lemmy.ca

- !new_communities@mander.xyz

- !communityspotlight@lemmy.world

- !wowthislemmyexists@lemmy.ca!

For more involved tools to find communities to join: check out Lemmyverse!

💬 Additional Discussion Focused Communities:

- !actual_discussion@lemmy.ca - Note this is for more serious discussions.

- !casualconversation@lemm.ee - The opposite of the above, for more laidback chat!

- !letstalkaboutgames@feddit.uk - Into video games? Here's a place to discuss them!

- !movies@lemm.ee - Watched a movie and wanna talk to others about it? Here's a place to do so!

- !politicaldiscussion@lemmy.world - Want to talk politics apart from political news? Here's a community for that!

Rules and Policies

Remember, Lemmy World rules also apply here.

0. See: Rules for Users.

- No bigotry: including racism, sexism, homophobia, transphobia, or xenophobia.

- Be respectful. Everyone should feel welcome here.

- Be thoughtful and helpful: even with ‘silly’ questions. The world won’t be made better by dismissive comments to others on Lemmy.

- Link posts should include some context/opinion in the body text when the title is unaltered, or be titled to encourage discussion.

- Posts concerning other instances' activity/decisions are better suited to !fediverse@lemmy.world or !lemmydrama@lemmy.world communities.

- No Ads/Spamming.

- No NSFW content.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

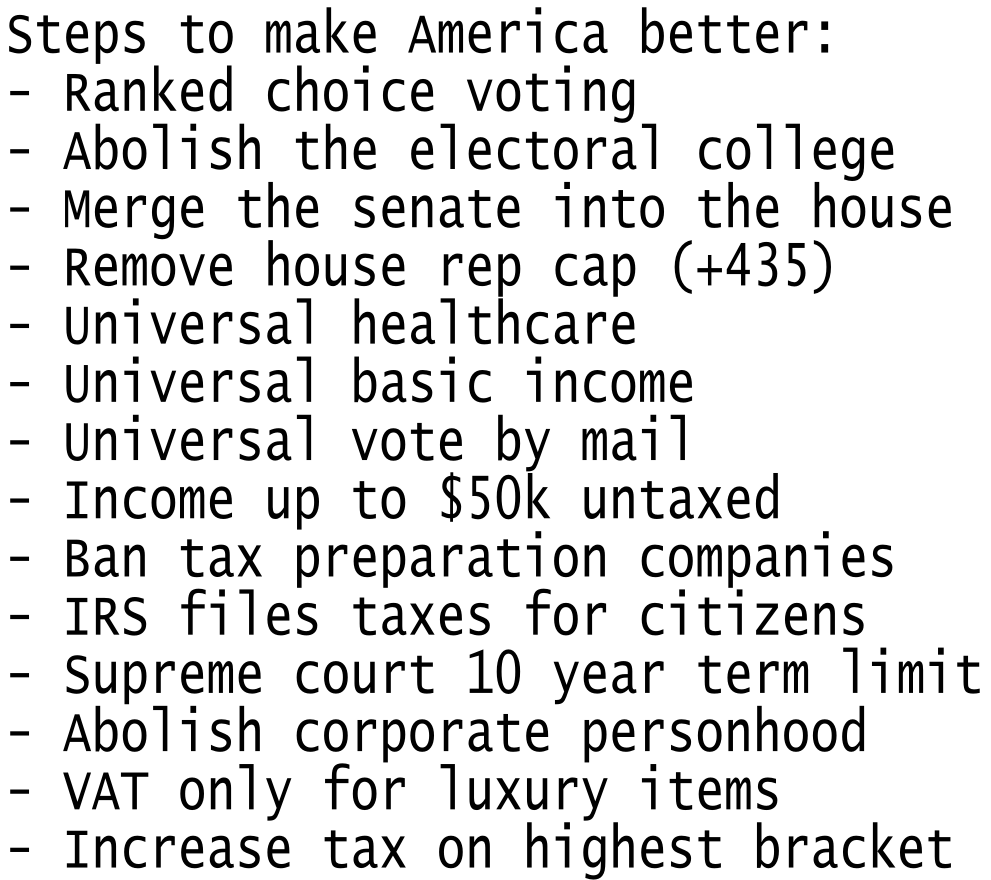

I wouldn't set a hard number value for this. Make it based on how low income is defined, or something dynamic that can change over the years with inflation.

For example, in parts of California you could be making $80k and you would still be considered low income because of how expensive it is just to live there. After paying for housing, there won't be much left over.

At minimum, tie it to inflation. But better yet, tie to cost of living and housing prices in a district.

The problem with that is that will cause areas to drive up housing prices to expand the untaxed group to general more "upper middle class" to price out undesirables and draw in higher earners as a form of tax break. This already happens without the tax bracket scaling and would probably get 10x worse.

I don't have a great alternative, but maybe a weighted CoL combined with 0% below median income in the district? Something like that, but that would probably cause low CoL areas to pay way more taxes. Maybe I am thinking of it wrong.

Or to GDP, so lower income people will benefit from increase in productivity via lower taxes?