this post was submitted on 25 Jan 2024

948 points (99.1% liked)

People Twitter

8585 readers

864 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a pic of the tweet or similar. No direct links to the tweet.

- No bullying or international politcs

- Be excellent to each other.

- Provide an archived link to the tweet (or similar) being shown if it's a major figure or a politician. Archive.is the best way.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

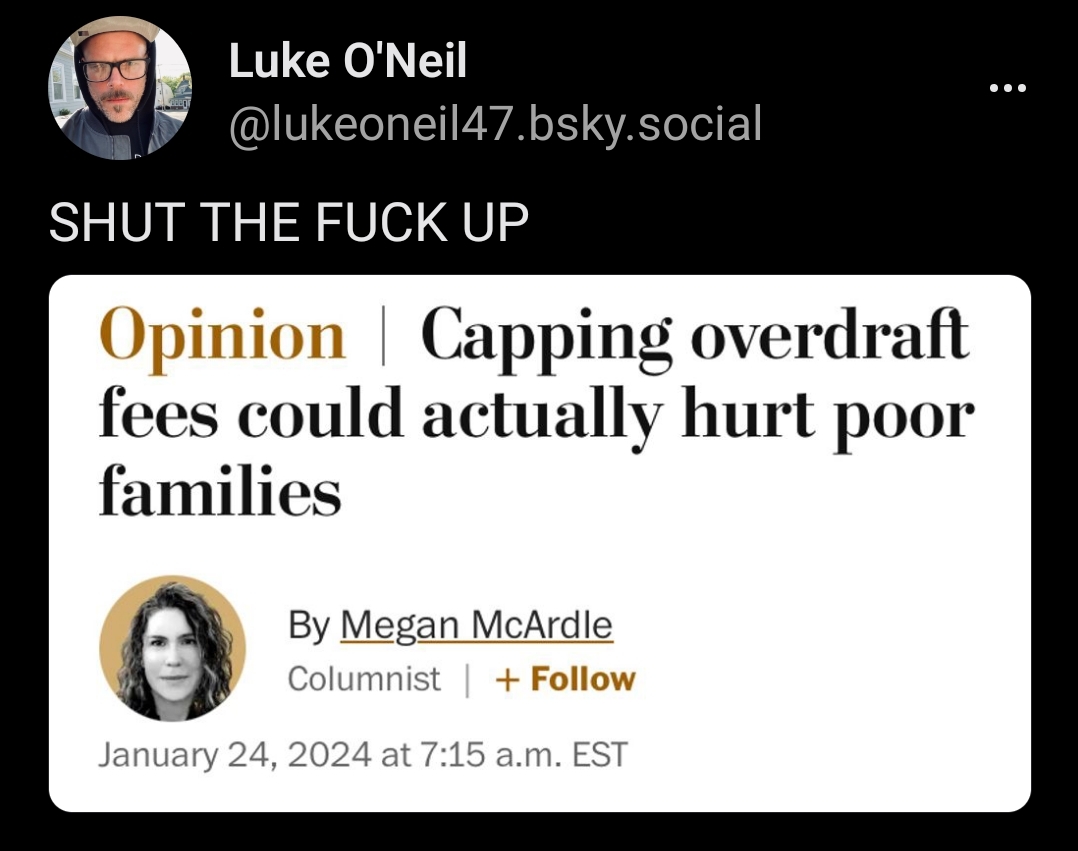

I agree, overdraft fees should be banned all together. Just decline the transaction. This is such horse shi..

A couple decades ago I opted out of overdraft protection for this very reason, so the bank would just reject the charges, and then hit me with a $36 fee anyways. Fucking criminals.

Yup, this is how overdraft protection works at my bank too. Like, what costs money in just saying "transaction declined"? It's not like the banks owe money to themselves on an OD account.

It's even more fun when they transfer from your savings account to cover the overdraft and charge you the overdraft fee anyways.

I encountered this enough with my CU; after kicking my college-induced points-fueled credit card habit; that I just decided to switch to a fee-free checking account with capital one. Physical branch locations be damned.

I could only tolerate so many multiple $3 charges a day, with no specific notification, for a service (a savings transfer) that would be completely free if I were to initiate it. And then "we can refund up to 3 overdraft charges but you should monitor your accounts more closely". lol. Keep your $9 and shove it, I shouldn't have to babysit my fucking credit union to keep their hands out of my pockets as I'm going through a major life transition like this.

Anyways. Capital one's verification process has been a bit of a headache but I'm currently trusting the process.

Overdraft is optional on every account I've had tbh.

It ought to be defaulted to Off.

I've turned it off every time but I have to ask every time. They don't even tell you it's default to on cause they wanna collect the fees.