this post was submitted on 14 Jan 2024

657 points (98.2% liked)

People Twitter

8520 readers

1887 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a pic of the tweet or similar. No direct links to the tweet.

- No bullying or international politcs

- Be excellent to each other.

- Provide an archived link to the tweet (or similar) being shown if it's a major figure or a politician. Archive.is the best way.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

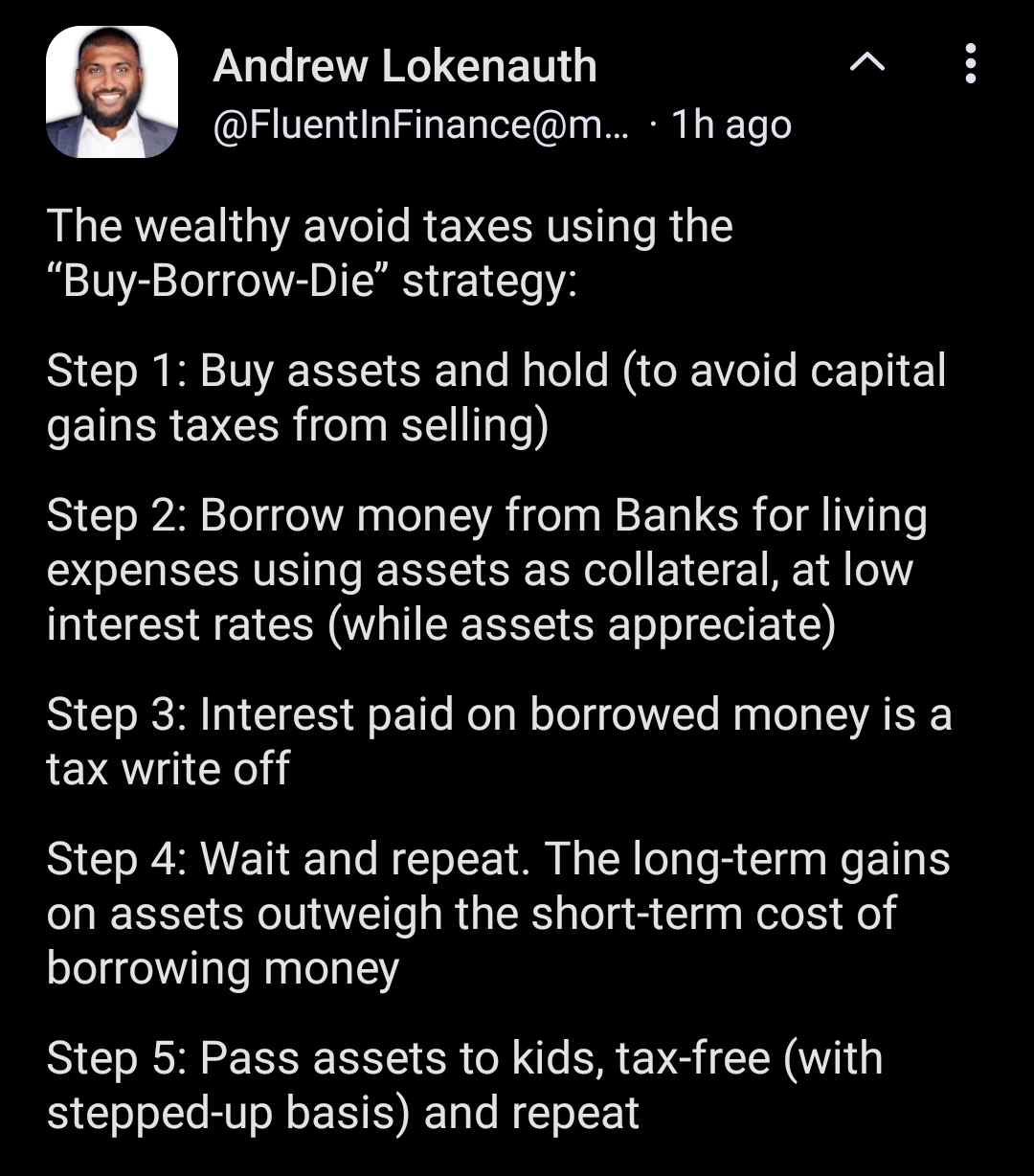

Only mortgage interest is tax deductible and there's a cap. You can't just deduct whatever you want. The big win is most "income" is long term capital gains, which isntaxed at a lower rate.

Yeah the tweet really showing how clueless they are there.

He got the details wrong, but the important part right. They live off of loans and either let the interest ride or only sell enough assets to pay the interest. When they die, their heirs can sell as much as is needed to pay the loan tax free because the basis is reset to the current value of the assets when they are inherited.

This isn't the only thing they do, but it is one part of it